How to Store Credit Card Information on Your Phone

Storing credit card details on smartphones is a convenience many of us appreciate, but it's important to do it safely. This article provides practical advice on how to store credit card information, ensuring optimal security without compromising comfort.

Table of contents

- The potential consequences of insecure storage

- Top trusted apps for storing credit card information

- Secure PIN storage: multi-functional 7ID app

- Tips for secure storage

- Step-by-step guide for adding cards to secure apps

- Protecting your phone: safety tips

- What to do if you lose your phone with credit card information?

The Potential Consequences of Insecure Storage

Securing sensitive financial data is a must in the digital age. It minimizes threats such as data breaches and identity theft, builds trust, and ensures compliance. The bottom line is that effective data protection isn't just a shield against financial loss. It is a keystone of reputation and success in an interconnected digital landscape.

The potential consequences of insecure storage are severe and far-reaching:

- First, there is the threat of financial loss from the theft of sensitive financial data and the cost of remediating a security breach.

- Second, companies could face severe reputational damage, leading to reduced customer confidence and negatively impacting future business prospects.

- In addition, regulatory fines may be imposed for non-compliance with data protection laws.

- Finally, for individuals, insecure storage can lead to identity theft, disrupting personal lives and requiring significant time and resources to resolve.

Therefore, secure data storage should be a priority to avoid these issues.

Top Trusted Apps for Storing Credit Card Information

Worried about credit card safety? Several trusted applications are available today for securely storing credit or debit card data. Notable among them are:

- Apple Wallet. It is an app that not only allows users to store multiple cards virtually but also implements strict privacy and security measures to protect user data. It uses an encrypted number instead of your actual card number to keep your information safe.

- Google Pay is another widely trusted application that offers high protection. It allows users to store and use their credit card information for quick transactions while protecting their data with advanced encryption.

Both apps use a method known as tokenization, which replaces your sensitive data with unique identification symbols to secure your credit card information. While these apps have proven reliable, it is important to regularly check their security status as keeping your financial data safe is crucial.

Secure PIN Storage: Multi-functional 7ID App

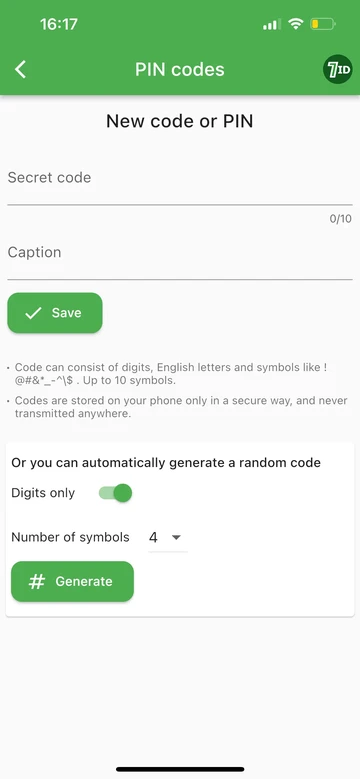

Always forgetting your credit card PIN but afraid to keep it unencrypted on your phone? Here is the solution to your worries—the multi-functional 7ID App. Expertly designed to make PIN storage easier, the 7ID App is your digital vault for storing all your essential codes.

The app aims to simplify the process of storing and managing PIN codes and passwords with features such as:

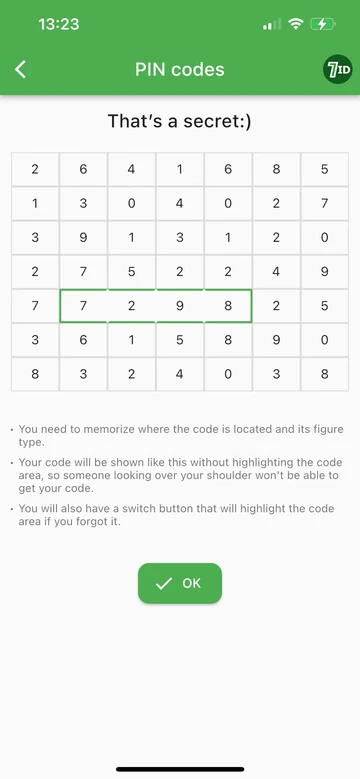

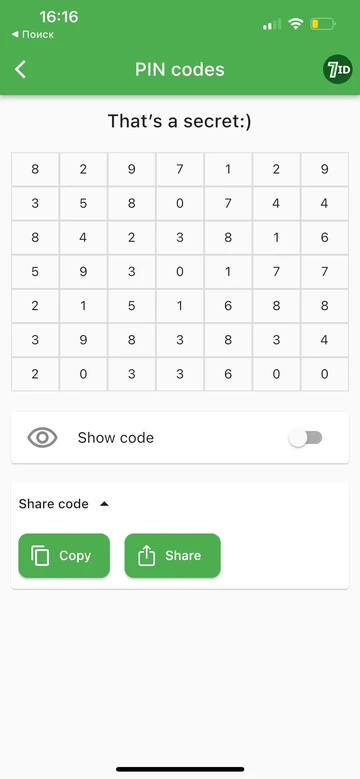

- Code hiding and storage technology. When you enter your code into the 7ID App, it immediately generates a series of numbers that effectively hide your code. Your task is to remember the exact location of your code in this generated sequence, making it somewhat indecipherable to others.

- Code labeling for added security. To keep things organized, give each code a name or label. We recommend choosing a “secret name” for each password so that even if an unauthorized person breaks into the application, they cannot decipher the function of the stored codes.

- Customized access and secure code viewing. The 7ID App ensures that only you have access to your stored information. Whenever you need to see a PIN or password, the app will display the numerical sequence, but only you will know the true location of the code. If you forget the location, you can always use the “Show Code” feature, making sure no one is around to prevent unauthorized monitoring.

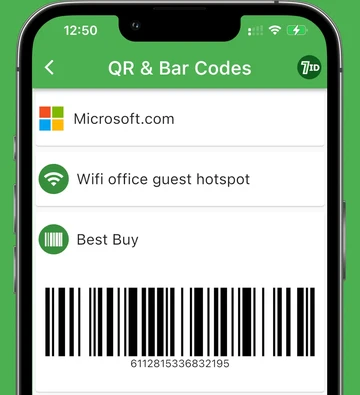

Moreover, the 7ID App is not limited to storing passwords. With its multi-functional features, in addition to password storage, you can create and edit ID photos, arrange QR and barcodes, and use your e-signature at your convenience!

Tips for Secure Storage

For secure storage, consider these essential tips:

- Use strong, unique passwords and passcodes to ensure that your accounts are difficult to breach.

- Use biometric authentication, which utilizes unique physical characteristics such as fingerprints or facial recognition, for an extra layer of safety.

- Implement regular app and system updates to plug security holes and stay ahead of potential hackers.

- Use device encryption, which converts your data into unreadable text for anyone without authorized access.

- Monitor your accounts regularly for suspicious activity, so you can quickly identify and resolve any unusual patterns.

- Limit the number of stored cards within your apps, reducing potential access points for fraudsters.

How to send credit card information securely?

Sharing credit card information should always be done with caution, as even the slightest carelessness can expose you to card fraud and identity theft. Here are a few ways to share credit card information safely:

- Use a safe platform: Encrypted email, message service, or secure file transfer app.

- Verify website security: Look for 'https' in the URL and a padlock symbol.

- Share over the phone: Only in private and with trusted individuals.

- Consider virtual credit cards: These provide rotating numbers for added protection.

- Use trusted banking apps: They usually have top-end security.

- Password-protect digital files and share the password separately.

- Avoid emailing or texting unless it's encrypted.

- For businesses, ensure your payment processor is PCI DSS compliant.

- Never share the CVV unless necessary, and you trust the receiver.

Step-by-step Guide for Adding Cards to Secure Apps

Here's a basic step-by-step guide for adding cards to secure apps. Please note that the specific process may vary slightly depending on the app:

- Open the secure app: Locate and open the secure app on your device.

- Navigate to Add Card feature: Look for an option such as “Wallet”, “Add Card”, or something similar. The name and location of the feature can vary depending on the app you're using.

- Enter card details: Input your card's information, which typically includes the payment card number, expiry date, and CVV. Some apps may also ask for the cardholder's name.

- Verify your card: For safety reasons, many apps require a verification step. This might involve a small transaction, a one-time password (OTP), or a call to your bank.

- Confirm and save: Once you've filled out and verified all required information, confirm the details and save or add the card to the secure app.

- Enable security features that the secure app offers for added cards. This could include biometric identification or two-step verification.

Remember always to protect your information and only enter your card details into trusted and secure apps.

Protecting Your Phone: Safety Tips

To help you keep your phone safe and secure, here are some security tips:

- Make sure your phone's operating system and applications are up-to-date. Updates often include safety patches to protect against new threats.

- Make sure you have a unique password or passcode that's hard to guess. Avoid using easily guessed details such as birthdays or sequential numbers.

- Use biometric security, such as fingerprint Touch ID, or facial recognition, for added protection.

- Download apps only from reputable sources, such as Google Play or Apple's App Store, and review the permissions that apps require.

- Enable the Find My Device feature (or equivalent, depending on your device), which allows you to locate, call, or wipe your device if it is lost or stolen.

- Be cautious with unfamiliar links received in emails, texts, or social media.

- This feature is available on most smartphones and makes it more difficult for unauthorized users to retrieve information.

- It's best to avoid public Wi-Fi networks when conducting sensitive activities such as online banking to prevent potential hacking attempts.

- Be mindful of the amount of personal information you share on your phone, as this could make you a target for cyberattacks.

- Back up your data regularly to avoid losing important information if your phone is compromised.

Remember, your phone carries much personal information, so it’s worth taking these steps to keep it safe.

What to do if You Lose Your Phone with Credit Card Information?

Losing your phone can be a stressful experience, especially if it contains sensitive information such as credit card details. Follow these steps if you find yourself in this situation:

- Dial your phone number: The first effort should be to dial your own number in hopes that an honest finder will respond and return it.

- Use a device locator: If dialing fails, use an app such as “Find My Device” to track the physical location of your phone possibly. This feature is available on both Android and iOS platforms.

- Remotely secure and wipe your device: If tracking fails, remotely secure your device and erase all sensitive data. This can be done through the 'Find My Device' service or through specific third-party apps.

- Change passwords and login credentials: Change all passwords and login identities for any accounts, especially those related to financial services, that were accessible through your phone.

- Contact your credit card company: Reach out to your credit card company and report the incident immediately. Once reported, you will be relieved of any financial obligations resulting from unauthorized charges.

- Check your account: Check your bank and credit card accounts for any unrecognized charges. Contact your financial institution immediately with any questionable transactions.

- Explore credit card protection: Some credit card providers offer mobile phone protection, which provides financial assistance to repair or replace lost or stolen phones. It's a good idea to check if these services are available to you.

If you lose a phone that contains sensitive credit card information, it is important to act quickly and decisively. Following these steps can help protect you from potential financial loss and identity theft.

Storing credit card information on your smartphone is valuable, but it leaves room for potential security risks. By following the precautions and methods outlined in this article, and using a special 7ID Card PIN Safeguard App, you can effectively protect your financial information.

Read more:

PINs Decoded: The Essential Guide to Personal Identification Numbers

Read the article

Canada PR (Permanent Residence) Card Photo App

Read the article